How Claude Code Is Transforming Finance—Without Turning You Into a Coder

- Get link

- X

- Other Apps

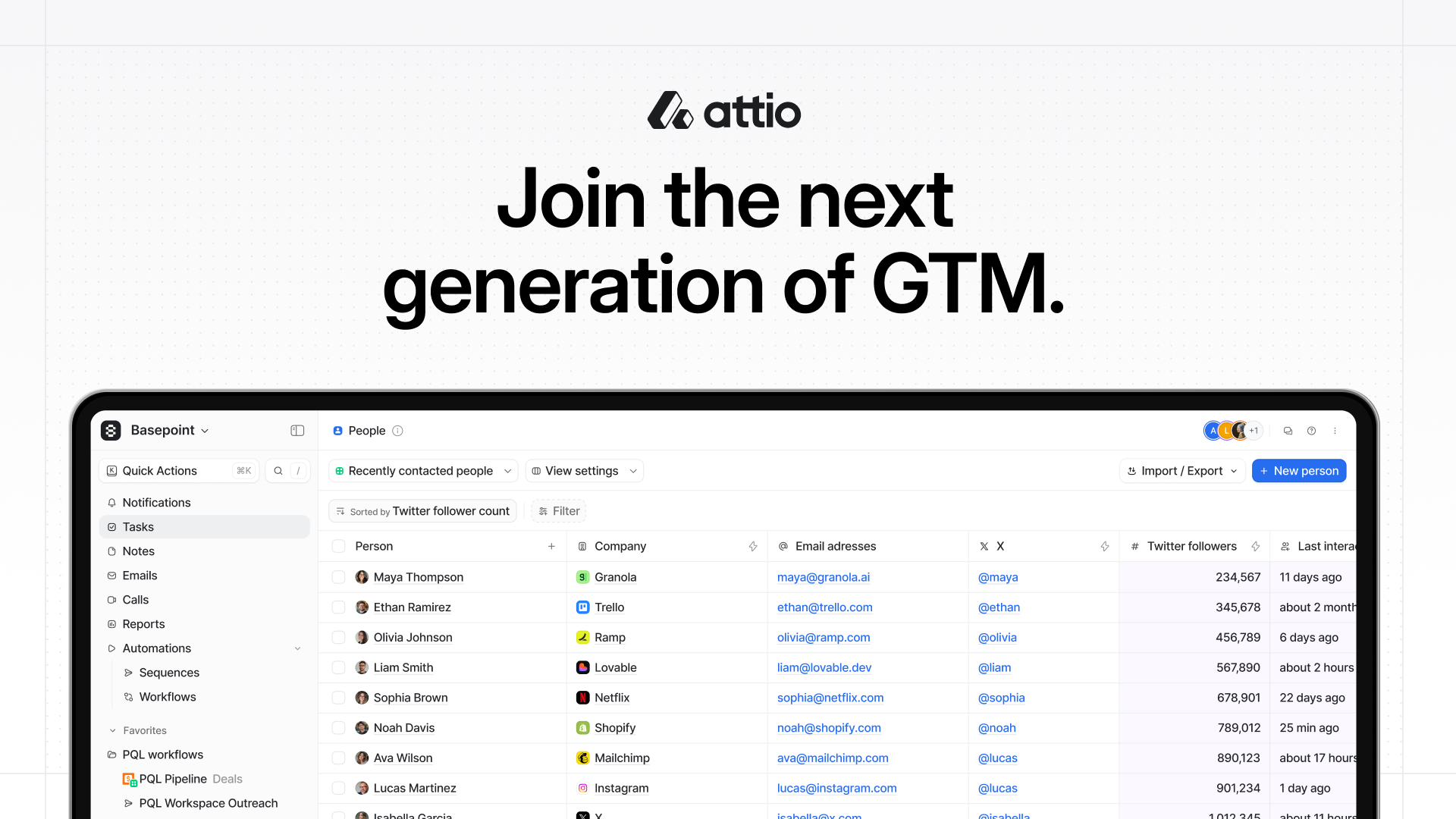

How Claude Code Is Transforming Finance—Without Turning You Into a CoderWith ChatGPT or Claude, you're only using a fraction of what LLMs can deliver TL;DR: As the head of financial services consulting at Every, Brooker Belcourt has helped take top hedge funds, asset managers, and research teams from AI-curious to AI-native. Today, he shares the reasons why the financial industry—one of the best placed to take advantage of AI—still isn't getting the most out of this new technology. It doesn't require investors to become coders, just proficiency with Claude Code and a clear view of the tasks to automate—lessons that apply to any industry.—Kate Lee Plus: If you work in finance and want to learn more, join us on March 13 for a day-long Claude Code for Finance course. We'll get you set up with Claude Code, download the Every investor plugin, set up the Daloopa MCP and Carbon Arc MCP, and customize the plugin to your investment philosophy. Register for the course. If any industry was made for AI, it's finance. The workflows are structured, the tasks easy to map out. Investment processes live as written procedures, compliance requirements, and repeatable research frameworks. An earnings review has defined steps. That predictability is exactly the environment where AI thrives. But working with hedge funds, asset managers, and research teams as part of Every's consulting team, I've learned that investors aren't always getting the most out of AI. We've seen this pattern repeatedly: A team gets excited about AI, spends a few weeks trying to get something working, hits a technical snag, and quietly goes back to doing things the old way. It's a funny little conundrum that firms in one of the industries best fit for AI struggle to figure out how to implement it. But several low-hanging solutions can accelerate AI adoption in finance. Here's a primer on how to get started, based on what I have seen from six months of supporting firms representing more than $100 billion in assets under management. Attio is the AI CRM that thinks fast and acts faster.With Attio, AI isn't just a feature—it's the foundation. With powerful AI automations and research agents, Attio transforms your go-to-market motion into a data-driven engine, from intelligent pipeline tracking to product-led growth. Then ask Attio anything:

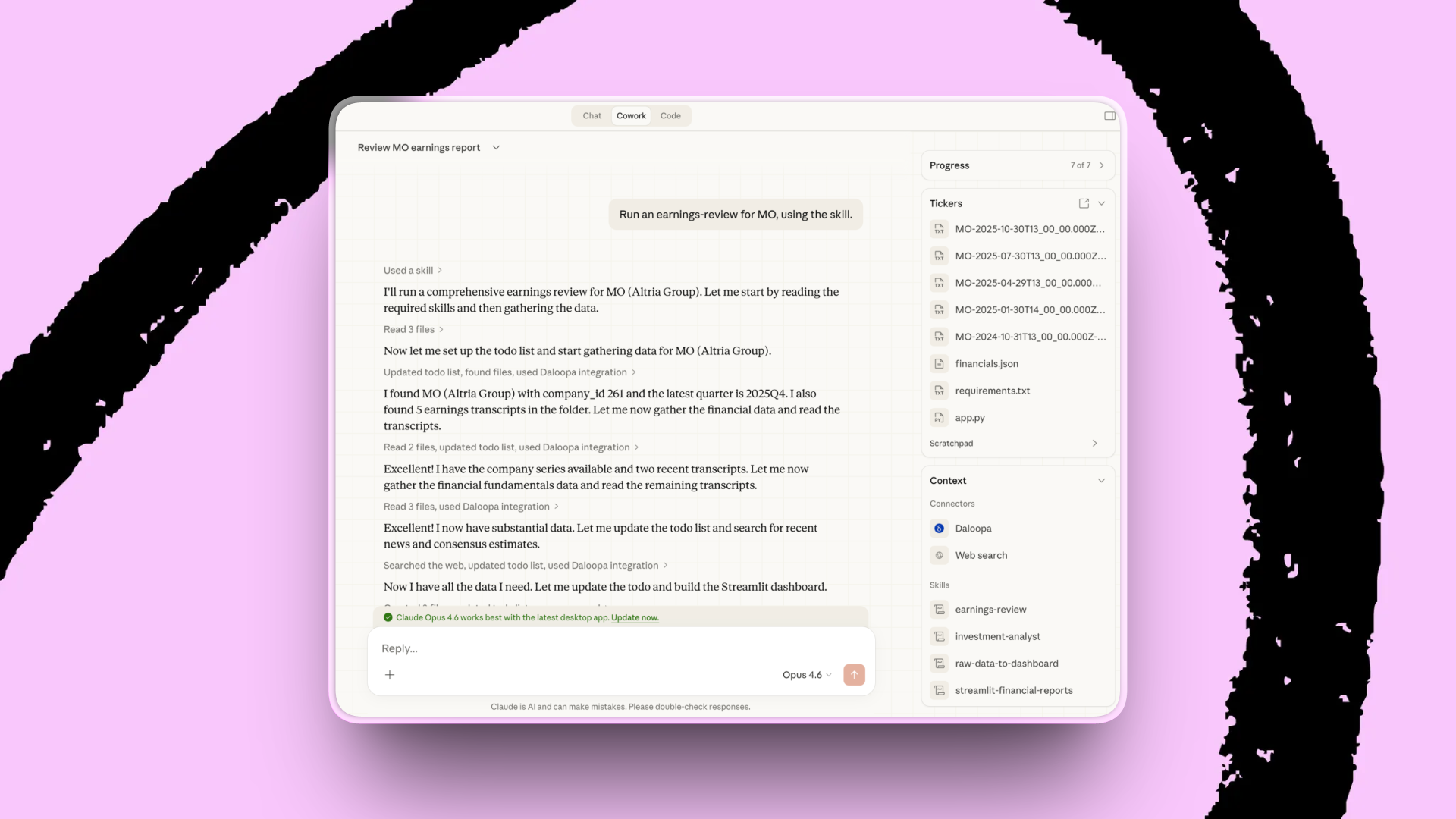

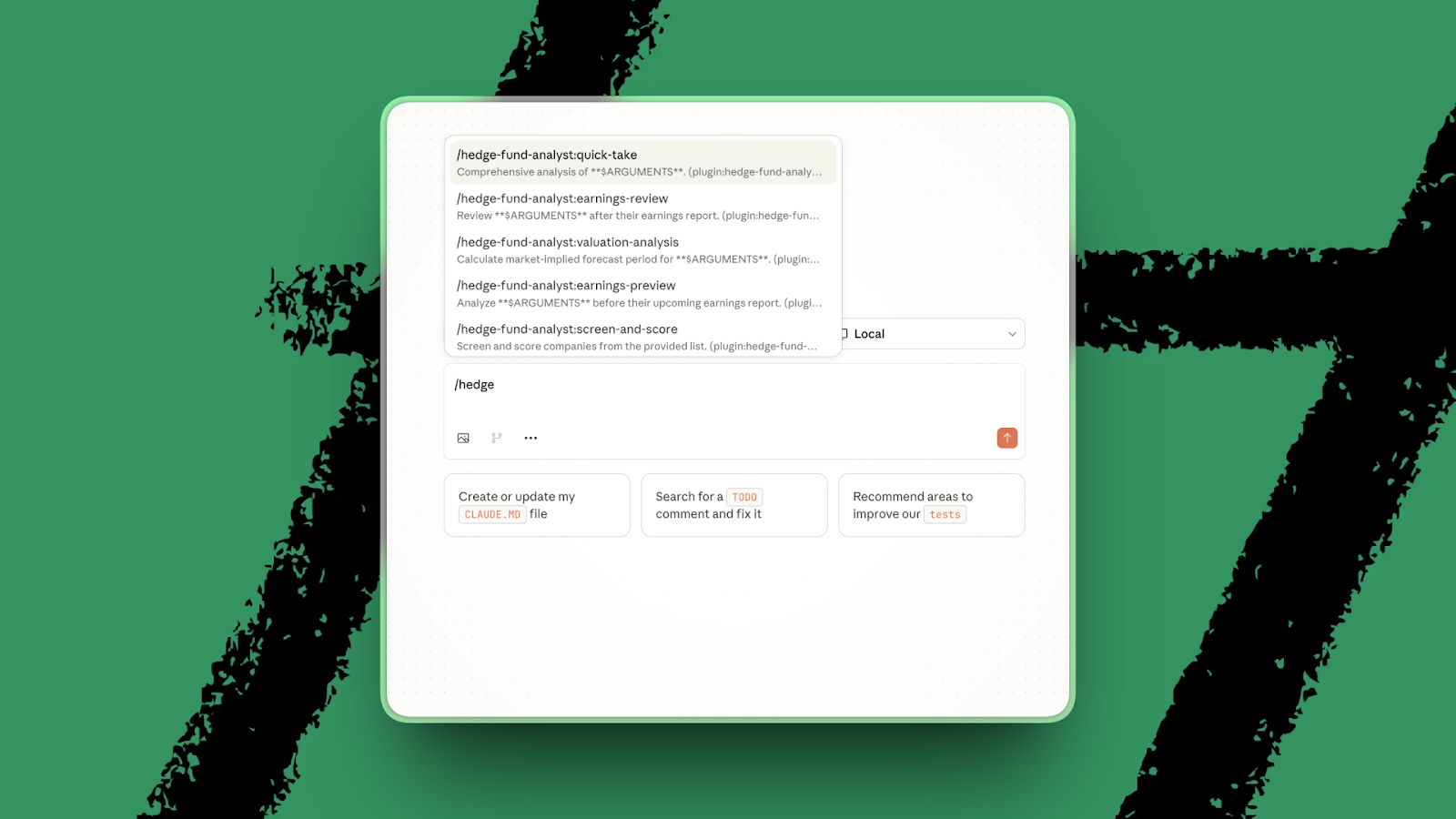

Teams at Granola, Lightdash, and Wisper Flow are already experiencing the future of GTM with Attio. Ready to build without limits? Start with Claude CodeFinancial services teams scour through earnings calls, portfolio reviews, and limited partner updates—massive amounts of data. AI is a natural solution to synthesize these inputs and quickly find patterns in them. However, common LLM tools don't connect to all of your data, and it can take too much time working with LLMs to get it right. If you're only using ChatGPT or Claude chat, they aren't built to handle complex, multi-step workflows and incorporate structured and unstructured data. Usually, the first step I take with finance teams is to recommend Claude Code. Unlike alternative LLM tools, Claude Code can run for hours on a single task, access all your files without limits—including folders and files stored locally on your computer—and write and execute code automatically. It can also plan, allocate agents to a task, and run work in parallel. This lets you tap into the full capability of newer models such as Opus 4.6 and GPT-5.3 Codex. It's also the best tool for large amounts of data and complex tasks. Data is useless unless you can connect data sets that don't naturally speak to each other. For example, in an earnings preview, which lays out what analysts and investors should expect to see in a company's quarterly earnings, Claude Code excels at connecting multiple data sets that are rarely paired together, including alternative data sets and fundamental data. This could be data that lives in the browser, such as economic data releases from a central bank, or in someone's Downloads folder, and historically would take an engineer to bring together. Define what you'd like to get doneThe second step for teams is to clearly define the task they need to complete. These are the most common tasks that we help financial professionals accelerate with AI: 1-Preparing for meetingsMeetings are important to close deals and make decisions quickly, but preparing for them is a major time sink. An analyst might spend hours pulling performance data, refreshing their notes on each stock holding, and summarizing what's changed since the last meeting before the team assembles to review an investment portfolio. Before an institutional investor updates their investors, someone on the team must manually compile returns data, write commentary, and make sure the narrative is coherent across the whole document. The firms we work with that have gotten the most out of Claude Code start here. An analyst defines what a good prep document looks like once, as a standalone skill or within a plugin. Then it's a question of the AI populating that format (be it email or notes) with the right data each time. Meetings are more consistent, rigorous, and effective. 2-Preparing for and reviewing earnings callsIn the U.S., the world's largest equity market, public companies are required to report financial results quarterly. The earnings call—a live event where management walks through what happened in the last three months—is the centerpiece of that process. Leaders give updates on their forecasts and take questions from analysts. But these earnings calls generate copious amounts of material: prepared remarks, a Q&A transcript that can run up to 10,000 words, a slide deck, and supplemental filings. For an analyst following 40 companies, earnings season can involve digesting hundreds of thousands of words of new material landing in a compressed window of a few weeks. Traditionally, an analyst might read a transcript, pull the key figures, check them against existing financial models, write an internal note on whether the investment thesis still holds, and flag any changes in management tone or comments about performance ahead. This process can add up to several hours per company, and, if it's done at the breakneck pace that earnings season requires, corners end up getting cut. Depending on which analyst is stretched that week, a company may be less analyzed with less scrutiny. The hedge fund we work with built an earnings preview and review system using Claude Code that changed this pattern. Completion rates went up sharply: Analysts finish reviews earlier and more thoroughly than before, which means the team can maintain consistent coverage across their entire portfolio rather than cutting corners when time gets tight. 3-Screening companies based on your investment philosophySome investors have to screen hundreds of investment targets a month, a process that involves sifting through volumes of filings, transcripts, building or updating financial models by hand, and writing up summaries. Only after all of this work is completed does a team form a preliminary view on whether a company is worth a closer look. This can take weeks of work. With Claude Code, you can encode your investment philosophy once and run it across hundreds of companies simultaneously. It's easy to get started here. For hedge fund clients, we write the investment philosophy as a Skill in Claude. It analyzes companies across transcripts, financial models, research, web data, and SEC filings, and scores each one against the firm's proprietary framework. It evaluates the factors the team cares about—financial trends, management quality, sentiment—and ignores the ones that matter less, like short-term price movements and valuation multiples. Forcing Claude to score investments allows you to compress analysis into a single number, increasing the number of investment opportunities you can consider as you gain comfort in the AI scoring. 4-Investment analysisWhen the price of a company, a cryptocurrency or a commodity moves sharply—up or down—teams scramble to figure out what happened. Was it the impact of a macro event, an investor making a big purchase or sale, or a shift in sentiment on social media? An analyst needs to make sense of a plethora of data sources quickly—price charts, an on-chain explorer to examine activity on a blockchain, a news feed, and a social media dashboard—trying to manually piece together a timeline. The biggest risk is that the moment passes by the time you've formed a clear picture. A large crypto fund we work with uses Claude Code to run this kind of "what happened" analysis automatically. When a significant price event occurs, Claude Code pulls together on-chain metrics for events happening on the blockchain, social media signals, and market data in real time to synthesize them into a coherent account of what drove the move. As a result, their team has increased the completion rate on prepping for meetings, leading to more productive conversations.. Because the team isn't waiting for an analyst to finish a write-up, they have a clear picture of the catalyst while it's still actionable. Working with ClaudeAnother blocker for investors adopting LLMs that I've consistently heard is that the setup, especially for Claude Code, can feel like an engineering project. Individuals need to be familiar with code, APIs, and stitching together data sources. Most analysts and portfolio managers don't have this background, and they shouldn't need to acquire it. We help financial professionals get over the cold start problem by building everything they manage, such as instructions for Claude and commands that trigger specific actions. This setup would take one person dozens of hours to create on their own. We have built plugins—bundled packages of skills and commands that can be shared and installed—that cover the most common workflows: earnings preparation, company screening, portfolio review, and analyzing the impact of big events. Each one encodes best practices that we've developed from our work. You can add these to Claude on desktop and then describe what you need in plain language, and you can customize them later to suit your own investing preferences. Beat the competitionThe workflows that feel cutting-edge today will be table stakes in two or three years, and the gap between firms that figured this out and firms that didn't will be visible in their output. The good news is that starting simply requires knowing what you're trying to do. If you work in finance and want to learn more, join us on March 13 for a day-long Claude Code for Finance course. Brooker Belcourt is the head of financial services consulting at Every. Most recently, he led the finance vertical at Perplexity. To read more essays like this, subscribe to Every, and follow us on X at @every and on LinkedIn. We build AI tools for readers like you. Write brilliantly with Spiral. Organize files automatically with Sparkle. Deliver yourself from email with Cora. Dictate effortlessly with Monologue. We also do AI training, adoption, and innovation for companies. Work with us to bring AI into your organization. Get paid for sharing Every with your friends. Join our referral program. For sponsorship opportunities, reach out to sponsorships@every.to. Help us scale the only subscription you need to stay at the edge of AI. Explore open roles at Every. Get More Out Of Your SubscriptionTry our AI tools for ultimate productivity  Front-row access to the future of AI Front-row access to the future of AI  In-depth reviews of new models on release day In-depth reviews of new models on release day  Playbooks and guides for putting AI to work Playbooks and guides for putting AI to work  Prompts and use cases for builders Prompts and use cases for builders  Bundle of AI software Bundle of AI software |

- Get link

- X

- Other Apps